By Alexander Knott

If you think back to the start of the pandemic – where all this began – that’s when you probably started hearing about UWA’s financial problems and wondered what was going on.

If you were curious enough you may have even pulled out UWA’s financial statements and checked the net result. If you did, you would have seen it was positive $120 million and scrunched your face in confusion. I mean… $120 million doesn’t sound like a deficit (even for the golden triangle) – it sounds great! Prompting the question: What the hell is the problem?

Fortunately, I’ve spent more time than I’d like to admit scouring the last several years of UWA’s financial statements searching for an answer. Unfortunately, it wasn’t the answer I was hoping to find.

The below represents a summary of a report I wrote for the UWA Academic Staff Association. You can find a copy of the full report here: https://alexanderknott.com/2021/08/assessing-uwas-financial-performance/

Problem 1: Income growth has slowly been outpaced by growth in total expenditure

Now, UWA is a big organisation and it does a few different things, but, these things can basically be categorised as “Teaching” functions, “Research” functions or “Other” functions. Critically, using UWA’s annual statements, we can see how much income UWA has generated from each of these functions over time (Figure 2).

On average, from 2014 to 2020, UWA received 47% of its income from teaching, 30% from research and 23% from other sources. Further, from 2014 to 2020, “Teaching” income increased $8 million (0.3% annual growth rate), “Research” income increased $7 million (0.4% annual growth rate), “Other” income decreased $5 million (-0.4% annual growth rate), and total expenditure increased about $43 million (0.8% annual growth rate) (Figure 2).

The key point is that over the last 7 years, income growth has been stagnant and slowly outpaced by growth in total expenditure (you don’t need a degree to know why this is important).

Problem 2: ‘Underlying’ performance has deteriorated since 2014

In 2019, of UWA’s $120 million net income, $128 million was from investments. Now, bearing in mind that UWA is a university and not a hedge fund (believe me, it’s debatable), you can argue that on this basis it would be misleading to conclude that UWA did well in 2019.

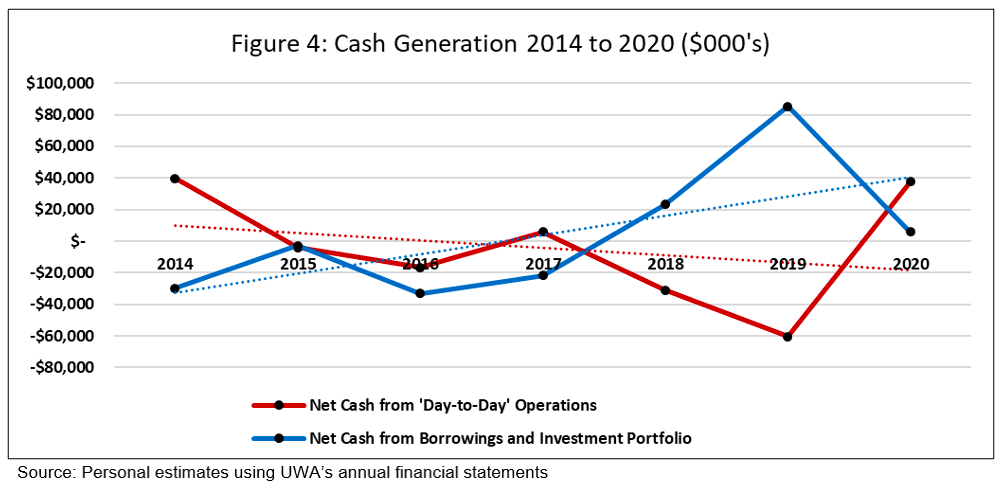

This notion that UWA’s net result may not reflect the ‘true’ performance of its operations is an important one as it motivates the calculation of an ‘underlying result’. An ‘underlying result’ is basically a financial performance measure that removes the effects of misleading income and expense items (e.g. investment income or changes to accounting rules) from UWA’s net income in order to gauge the ‘true’ performance of its ‘underlying’ operations. Without getting too technical, there are three main measures for assessing UWA’s “underlying” performance:

- UWA’s newly implemented ‘Underlying EBITDA’ measure;

- The Australian Group of Eight universities ‘Underlying Result’ measure; and

- A simple ‘Net Income Less Total Investment Income’ measure.

Although they all differ in their calculation, the one consistency across all three of these operating performance measures is that they have all deteriorated since 2014 (Figure 3). In other words, no matter how you slice it, it appears that the ‘underlying’ performance of UWA’s operations has been deteriorating for quite some time.

Problem 3: Ability to generate cash from ‘day-to-day’ operations has deteriorated

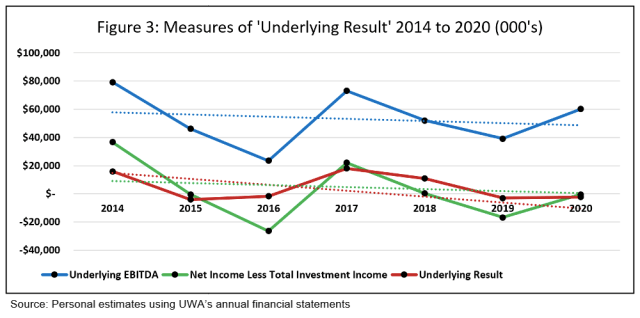

In addition to examining UWA’s income sources and ‘underlying’ performance measures, it is also important to know how much actual cash it is generating to assess its ability to meets ‘day-to-day’ expenses. To do this, figure 4 plots UWA’s:

- Net cash generated from ‘day-to-day’ operations each year; and

- Net cash generated from the repayments and proceeds from borrowings as well as the purchase and sale of financial assets each year (i.e. how much cash UWA generates from borrowing money and cashing in investments).

Examining Figure 4, net cash generated from ‘day-to-day’ operations has trended downward whereas net cash generated from borrowings and investment portfolio has trended upward. Further, there appears to be a significant cash deficit in ‘day-to-day’ operations, particularly over 2018 and 2019. Combined, these results suggest that UWA has become increasingly reliant on borrowing cash or ‘cashing in’ investments to fund a cash deficit in its ‘day-to-day’ operations. This likely represents the “structural deficit” or “cash deficit” in UWA’s operating activities that is referenced by Vice-Chancellor, Professor Chakma.

Problem 4: Transparency

UWA’s financial performance has been deteriorating, but a lack of financial transparency has made its severity difficult to see and verify.

For example, you may have noticed that while I disaggregated income sources according to the functions they were derived from, I did not similarly disaggregate expenses. This is because, while it is possible to see, with fantastic detail, how much UWA makes from “Teaching”, “Research”, and “Other” functions, it is impossible to determine how much it spends on these functions. This makes assessing UWA’s performance difficult.

Another important example relates to the structural deficit… defined as the “cash deficit in our core general-purpose funds (excluding investment and restricted income) and the additional operational investment we should be making each year on infrastructure improvements”. Given that there is so much focus on addressing this structural deficit, it would be nice if the information used to calculate it was publicly disclosed (e.g. what constitutes “core general-purpose funds”, “restricted income”, and the “operational investment we should be making each year on infrastructure improvements”?). Without this information, we are left second-guessing and confused.

The key point is that without more transparency, it is difficult to verify the extent of UWA’s financial problems, and if these problems are difficult to verify, it is difficult to believe the extreme actions taken to address them are necessary.